The Wrap #28 | Dragons wearing lipstick, frolicking in the metaverse

A shot of thinking fuel, brought to you each month by Futurestate Design Co.

Welcome to the shortest month of your life so far (as a %). You’ll notice that this month we’ve finally moved The Wrap to Substack. Paid subscriptions will only be £1,200 per month. You have already been billed on a pre-pay basis. Thanks.

Oh come on, we’re not an energy company. We’re still free as a bird, we can now do this with less aggro, and all of our stuff is now in one place. Whoop.

This month, we give you our take on why the demise of unicorns is a really good thing, how to think differently about market indicators and what you offer, and why you can’t wish your way to success.

Let’s crack on then.

Dragons are eating Unicorns

What’s going on?

In 2021, 537 unicorns emerged. This year unicorns will be in much shorter supply, but dragons are now all the rage, so they won’t be missed. Having a company valued at $1 billion or more was the dreamy-eyed goal of many VCs and the stimulant-fuelled, bleary-eyed power play for tech startup founders. Now, not so much. It turns out that sometimes, only sometimes mind, some of those people would cut corners and do irresponsible things to get to that unicorn status. We’re shocked.

In this Fast Company piece, Maëlle Gavet sets out why investors are now looking for businesses that are, well, proper businesses. Explaining how the pursuit of unicorn valuations in the tech world has led companies to de-prioritise business fundamentals, shovelling mountains of investors’ cash into buying ‘customers’ at the expense of creating a sustainable business.

Why is this important?

Finally. Finally, finally, finally. The nonsense that was scale-at-all-costs, figure-it-out-later thinking is dying, in favour of a focus on creating real businesses. Don’t ask us why calling a real business a ‘dragon’ was a good idea but hey. FWIW, we’d have gone with stallions.

The ‘out’ for many investors until now was a public IPO, but with markets in a mess, the chances of getting that big payday is next to nil. So, it’s back to business 101: create something that can make money and can build a growing, sustainable market position. Maybe even a somewhat defensible one (good luck with that).

Getting out of the “it’ll be worth MILLIONS! BILLIONS!” mindset that even corporate innovators got into is a very important phase in the innovation economy. It’s reckoned that one in four startups return the capital invested in them. Most of those are sold to another company. Only a very small % become viable long-term businesses. Perhaps, now that we’re in the age of the dragons (perhaps not this one), everyone will focus on building businesses, not myths.

Follow our simple golden rule. Users just use you. Customers pay you what you’re worth.

Read Maëlle Gavet’s article here

The economic forecast: Lipstick up; pants down

What’s going on?

Consumer behaviour during an economic downturn can be somewhat – unpredictable. This glorious piece from The Department (extracted from their podcast) walks us through a history of some of the most reliable indicators for economic health and stability. And they might surprise you.

Some of you may have heard of the Lipstick Index: basically a predictor of economic health based on lipstick sales. In the 2001 and 2008 recessions, lipstick flew off the shelves – the theory being that (mainly) women purchased more of something relatively inexpensive that could make them feel good about themselves. Conversely, a downturn in men’s pants (we know how many types of wrong that sounds) is rooted in the fact that men think of them as ‘invisible’ – so in tough times, men will replace them last, by which point they resemble fishing nets. You get the idea.

So, given that most trends are not worth the electricity it costs to display them, might there be other, more lateral indicators like these that can be used to provide insight into the state of things, and how people feel about it?

Why is this important?

Well, lipstick sales are up 48% YoY apparently – so there’s definitely a crunch. And we can’t walk down the road now without thinking about the whole ‘not replacing the pants’ thing. So that’s ruined the daily dog walks.

But more seriously, it’s worth thinking hard about both what indicators can give your business clues about market conditions, and what you might do with your product or proposition to align with how buying customers feel about life. Look in unexpected places, and be prepared to think laterally about what each might mean. And don’t assume that what many might consider an unnecessary ‘nice to have’ like lipstick will sell less well when things get tough. It’s actually the ‘nice to have’ that makes it attractive.

Here’s one that you can all pay attention to:

One of the first observations on the Necktie Index is that (in general) - the more senior officers of the company wear neckties, and the more meetings they attend, the more trouble the company is in.

Beware the tie. You’re welcome.

Listen to the The Department podcast here

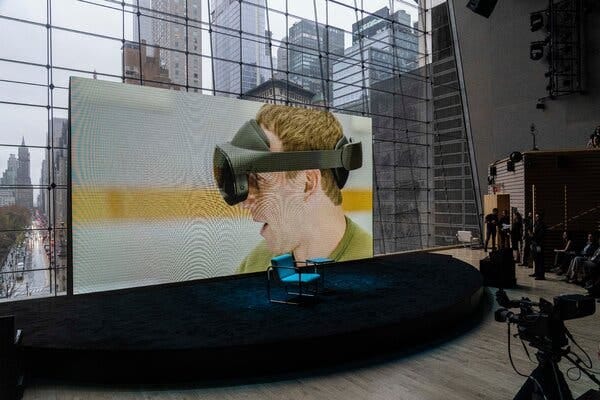

The Meta Kool-Aid is tasting a bit off

What's going on?

Big tech is in meltdown. Ok, it’s not, but it makes for better headlines. The layoffs across the sector have been widely publicised, with many tens of thousands of employees of Amazon, Google, Meta et al being ‘let go’ (don’t you love that expression?).

In this NYT piece, journalist Mike Isaac lays out some of the pressures facing Meta, who are absorbing a $4.2Bn restructuring charge as a result of their 11,000 layoff restructure (the share price soared on this announcement: what a world we live in).

The Zuck has been investing gazzilions in the metaverse but the core advertising business has struggled, not least because Apple disabled one of the key ways that Meta tracked you across the internet so that it could exploit that data without you knowing to promote terrible things to you. And breathe.

Along with many of those lofty peers, the cuts reflect two things: hiring too many people based on assumptions about the market, and a business model that is fragile, despite its scale. With the inspiring management theme for 2023 – the ‘Year of Efficiency’ – tattooed on his exec team, the article cites: “Mr. Zuckerberg and others admitted they had been too quick to estimate that a largely digital life was the new reality for many”. ‘Too deluded to estimate’ would have been more accurate, surely?

Why is this important?

Ok, ok, Meta-hating aside, there’s a ton to unpack here that should matter to everyone else. Let’s focus on two.

First, the business model. Meta’s vast investments in the metaverse (can we call it the metafarce yet? Too soon?) have been funded by its advertising business, which is in turn built on its ability to stalk you across the internet and show you ads and content that make Meta money. In one simple privacy-focused move, Apple cost that model $Billions. The economic downturn has cost it even more $Billions. And based on lipstick sales, that’s only going in one direction.

Two billion users use Meta’s services but only a tiny % of those are paying customers (generally businesses). It’s basically a one-trick pony. So when the fan gets hit there are few levers you can pull to do anything about it – except cut costs and hope you can keep investing in virtual sofas at the same rate. Interestingly, the only major tech company that hasn’t announced swingeing cuts (to date) is, yes, Apple, who only have a very, very tiny % of users: almost 100% of their customer base paid and/or pays them directly, in real money, and they’re super-loyal – so that position is very defensible. Hmmm, maybe there’s something in those dragons after all, eh?

The second is even more critical for everyone else. In a joyous ironic twist, they believed their own hype at the expense of reality. Of course we’re not all ready to live ‘largely digital lives’. And of course there will eventually be a virtual world of some kind. But between now and a large enough ‘many’ of us inhabiting it regularly to make it pay, there’s a yawning canyon.

Everyone should think about how to create new customer behaviours, but we’d caution against centring the ambition in changing the entirety of human existence. Maybe Meta have enough money to make it a reality, and maybe not, but we’re betting that no-one reading this is willing to burn cash for fun. Please, keep your futurestate within reach.

Read The New York Times article here

Thanks for joining us this month. We’re off to create the Futureverse. Anyone want to buy an ad in next month’s edition? Only $4Bn. Anyone?