Using competitive analysis in concept design

Competitive analysis can be powerful... if used well.

Creating innovative services requires the ability to look at a defined market and turn a ‘gap’ into an opportunity. Used well, competitive analysis can help you unlock your idea’s potential — just make sure you’re clear on the purpose.

Considering how many services are launched every day, it is likely that someone may have come up with your idea — or something close to it — already. It’s better to know that, which is why we frequently use competitive analysis to conduct a rapid evaluation of a given market space and assess the viability of new concepts.

If used properly, it is a tool that can reveal really valuable insights. There are numerous well-documented approaches, frameworks, and methods for how to approach it in the best way — but the reality is, any method is only useful if you know why you’re doing it and how to tailor it to your purpose to get what you need from it.

This article touches on some of the different types of competitive analysis, their characteristics and outcomes. It uses one of our own projects as an example to illustrate how you can adapt this tool and make it your own, so it becomes more useful for what you are trying to achieve.

The purpose defines the method

While there are many different types of competitive analysis you can undertake, at different points in the design process, the argument for doing it is almost always the same: to gather information that can inform decisions about a service’s strategy and design.

What differs are the characteristics you look at and the metrics you measure them with.

For example, in the case of a traditional UX-focused competitor review, you would usually be assessing competitors’ answers to key user needs or identifying innovative ways that they have used to solve problems you are trying to solve in your own service.

When working on positioning your service, you’d want to look at your competitor’s verbal and visual communication — that includes the lexical field, common words, proposition, use of colour, typography, imagery, etc — across all relevant channels. It should help you clarify your service’s values and characteristics and help you understand how to differentiate it among the industry’s existing players.

At the formative stages of a project, the aim is to understand the landscape of the market you’re working in. Here, you’re analysing the market to identify any gaps — i.e. needs or opportunities that are poorly addressed or not addressed at all. Opportunity mapping is a process we typically use at this stage as it can help articulate those gaps clearly and describe how they might be addressed.

The outcome of this process should leave you with a list of ideas which typically fall into two buckets:

An opportunity for incremental innovation: there are other services already addressing the problem your concept intends to solve. In this case, you have to evaluate whether there is space for a new player in the market. Crowded markets can still provide substantial opportunity if you can add value over existing offerings by improving the experience or tackling the same problem in a different way. For example, Uber is the big player in its market, but other services still managed to emerge by tackling the problem in a slightly different way: Via Van by focusing on shared rides, MyTaxi on Black cabs, Kabbee on airport rides, Didi Chuxing on the Chinese market, and so on.

Opportunity for a distinctive innovation: you have the potential to offer something that is unique and not being offered by anyone else. At this point, the key question you should ask yourself is: why? Is it a viable gap, or is there a good reason why it hasn’t been done? You may want to look at services that address a similar need or issue but in a different sector, or to a different audience. Are there services tackling part of your offering? If so, it is interesting to research them. This will help you identify what works well or not, highlight current behaviours and evaluate if there is a real opportunity to introduce new behaviours.

What does it mean in practice?

Let me give you an example we’ve worked on recently. Earlier this year, we decided to address the problem of waste in the fashion industry. After doing some research, we came up with an idea that would allow people to dispose of their unwanted clothes while allowing them to also receive a curated selection of second-hand clothes through a paid subscription. Part of this subscription would then be distributed to support the charity of their choice.

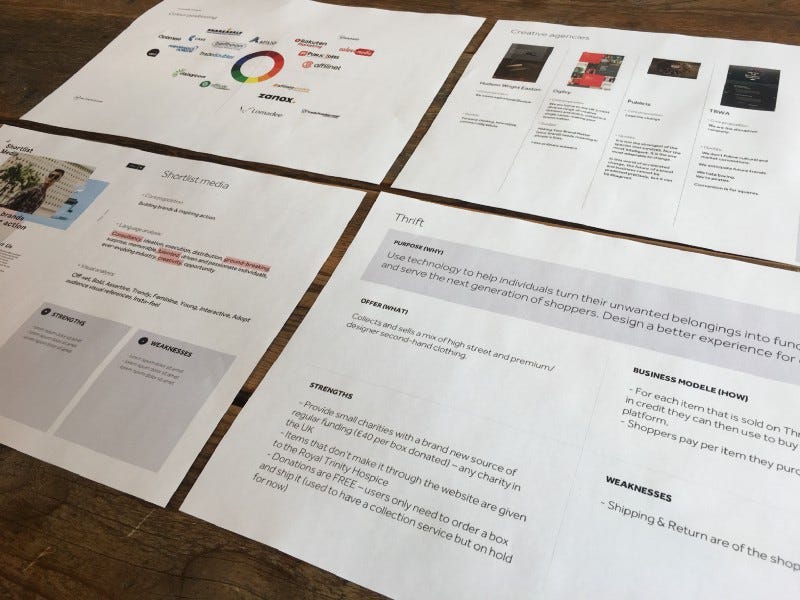

In our case, we couldn’t identify any service covering what we were proposing in its entirety, so we used competitive analysis to validate our proposition and refine the service definition.

We listed companies that either addressed a similar issue or covered a part of our offer and organised them in groups.

For each, we looked at the following criteria:

Proposition — what is the problem they’re addressing and how do they communicate it? In this case, try not to map the competitor’s offer but use it to figure out how to differentiate yourself clearly. Doing so should help you refine your proposition in the context of the current landscape.

Offer — what do they sell on what terms? The devil is in the detail here so collect as much as you can find. For example, when we looked at clothing rental platforms, we captured things like, who is it for (men, women, kids), what’s available to rent (any garment vs specific items like baby clothes, evening wear, t-shirts), how many items can a user rent at a time, can they choose which item, can they buy and keep the item if they like it, and so on.

Business model — what are the financial transactions needed for the service to work? Looking at competitors can highlight commercial processes you haven’t thought about and help you refine or find new ways to make money.

Functional strengths — are there key characteristics of the service that your users are likely to appreciate. For an online retailer, it could be free delivery/free returns; for a physical shop, it could be an extended period for the users to return an item.

Functional weaknesses — what is missing or poorly addressed that your service could take advantage of? What are the questions/uncertainties it raises? This is taken from our own research: “The clothes feel like they’ve been worn out. The pictures are amateurish and don’t fit the standards you’d expect from an e-commerce website”.

We captured our findings into a structured and consistent format. Spreadsheets are usually a good way to go but if you’re like me and need something more visual, you can make your own simple summary

Ultimately, choose your format to capture anything that will help to frame the opportunity more accurately and identify some key areas that your solution could focus on.

Communicating findings to drive decisions

It is frequent when running this type of analysis to end up with a prodigious amount of information which can be hard to process. Part of this exercise is to make sure you are clear on the key insights your research has generated so you are then comfortable communicating them with the broader team.

Synthesising results in diagrammatic form can really help to present essential aspects of the data in a digestible way.

One of the techniques we used in our ‘sustainable fashion’ project is the spider diagram, which can prove to be very useful when comparing companies from different industries with irregular sets of data. We extracted some of the key aspects of our service, added them with those that came up during our research and plotted them on our spider diagram against a series of axes that we felt to be important characteristics of what we were trying to achieve.

For each of the competitors we studied, we assessed the degree to which they met these criteria. It helped us identify our competitive advantage more clearly but also to identify how other actors in the market addressed similar issues — which validated, in a way, the need for our service.

Whatever techniques you choose, make sure it enables you to focus on the data that support the core purpose of your research (the ‘why?’ of the process) and presents any outputs simply and efficiently.

A process for tuning in

This process should help you decide how — or if — you should progress your idea. It should help to determine if there really is a gap worth exploiting, and if so, what the next steps might be to move it forward (customer research to gauge market appetite; business modelling to assess if the idea is financially sustainable, etc).

Remember that every case is unique and it is worth taking the time to design your own approach and methods to ensure that you actually end up with outcomes that are of real value to the design process.

As a designer, competitive analysis is a tool that helps me empathise with the solution I’m shaping. Just as we use customer research to tune in to user needs and behaviours, looking at other actors in the market helps me tune in to where the service’s competitive advantage really lies and informs which aspects of the service should be emphasised in the design process.

Written with Julie Jouault